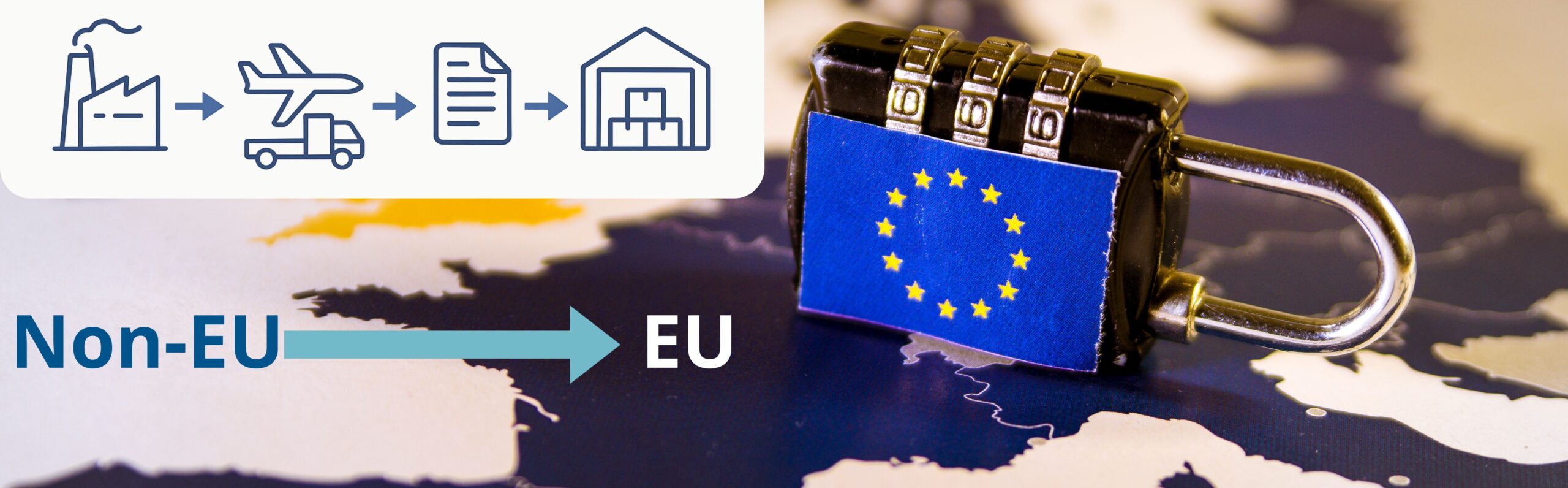

Importing medicinal products into the EU is a highly regulated process that leaves no room for error. From strict GMP expectations to complex customs procedures, each step can affect timelines and product quality. This article explores the main regulatory challenges and highlights practical strategies that help importers avoid delays, ensure compliance, and protect product integrity.

Key GMP Requirements for Importing Medicines

Importing medicinal products into the EU requires strict adherence to Good Manufacturing Practice (GMP) to ensure that products manufactured outside the Union meet standards fully equivalent to those applied within the EU.

A central expectation is that every third-country manufacturing site involved in producing, testing, or packaging the product operates under an EU-compliant quality system and holds appropriate evidence of GMP status, such as a valid GMP certificate or inspection record recognised by EU authorities. A key role in the import process is carried out by the Qualified Person (QP), who must confirm before taking any decision regarding the handling of a batch that the entire supply chain complies with EU GMP requirements. This includes, among other things, verifying the integrity and completeness of batch documentation, ensuring the suitability of the manufacturing site, and confirming that any deviations, changes, or quality concerns have been properly investigated and closed. The QP reviews all data related to production, transport, and quality of the batch in accordance with the requirements of Annex 16 GMP.

Companies importing medicinal products must also hold a valid Manufacturing and Importation Authorisation (MIA). The scope of this authorisation must reflect the specific dosage forms and activities performed, including storage, sampling, and testing.

GMP–Customs Interface: How Quality Requirements Affect Clearance Procedures

For many companies, customs clearance is the most unpredictable stage of the import process. Medicinal products are subject to strict scrutiny, and even minor discrepancies in documentation or product information can lead to delays, additional fees, or regulatory interventions.

Quality-related aspects of the product, such as correct naming, dosage form, batch number, and packaging specifications, can directly affect clearance. Customs authorities routinely verify these details against the documentation submitted by the manufacturer and the importer, checking for consistency across all declarations and supporting records. Any inaccurate or incomplete quality-related information may trigger additional inspections by customs or national regulatory agencies, causing significant delays.

Typical issues include:

- Complex documentation requirements vary between EU Member States.

- Incorrect tariff classification (HS/KN codes), leading to compliance questions or unexpected duties.

- Discrepancies between transport and quality documents, especially product names or batch identifiers.

- Additional inspections by customs, health authorities, or quality agencies.

- Communication gaps between logistics providers, customs brokers, and importers.

Best Practices for a Smooth Import Process

To successfully navigate imports, companies should implement practical measures and structured processes that prevent errors before goods reach the EU border.

Pre-import compliance checks: Develop a checklist to verify product information, certificates of origin, labelling, and shipping documentation for consistency with GMP.

Structured communication protocols: Define clear points of contact between manufacturers, importers, and customs brokers to resolve discrepancies quickly.

Training programs: Educate staff on GMP obligations, import regulations, and common customs pitfalls to reduce human errors.

Digital tracking and documentation systems: Use software platforms to manage shipment records, track transport conditions, and automate document validation.

Risk assessment and contingency planning: Identify potential delays or compliance risks in advance and prepare mitigation strategies, such as alternative documentation paths or expedited customs procedures.

Internal audits and process reviews: Regularly review import procedures and documentation practices to ensure they remain aligned with evolving EU regulations.

By implementing these strategies, companies can minimise delays, maintain product quality during transport, and ensure full compliance throughout the import process.

Importing medicinal products into the European Union is a complex process where GMP requirements intersect with customs procedures. By understanding the key GMP obligations, recognising how quality aspects influence customs clearance, and applying structured best practices, importers can reduce delays, protect product integrity, and maintain regulatory compliance. Careful preparation, accurate documentation, and proactive coordination across the supply chain are essential to a successful, efficient import process.

References:

https://health.ec.europa.eu/medicinal-products/eudralex/eudralex-volume-4_en

https://trade.ec.europa.eu/access-to-markets/en/content/pharmaceutical-and-cosmetic-products

https://www.ema.europa.eu/en/human-regulatory-overview/research-development/scientific-guidelines