Big pharma has the unlimited budgets, but is it true?

In 2012 the medical and patient world held its breath because of Sanofi’s new product launch – Zaltrap (afibercept), a medicinal product registered for the treatment of colon cancer and its price of 9600 $/month. The price of Avastin (bevacizumab), its closest competitor, was half of its price, since Sanofi’s treatment was so expensive, oncologists turned down the idea of using it. This situation forced Sanofi to slash the price in half, but neither this helped in this failed launch. Another example of overpricing is Glybera (alipogene tiparvovec) which marketing authorization expired and as uniQure biopharma B.V. confirmed that it did not apply for renewal of the authorisation due to the lack of demand for this product. Without proper market analysis and competitive review this kind of cost overrun can endanger big brands in the loss of brand trust, lead to marketing failure and finally what is obvious also cost a fortune. Nowadays, even smaller brands don’t hesitate to spend money for reliable recognition of the market. Does this problem also apply to generic drugs? It may seem that the introduction of a generic drug will guarantee market success. Therefore, is there anything to be afraid of? Is there any risk, anything can go wrong? Yes, there is an inherent risk of the market launch failure that may be often downplayed in such a “certain” project. As the pemetrexed case shows, some of drugs are approved on the market, while Hospira notified the European Medicine Agency of the withdrawal of the application due to the marketing strategy change. Later under the Pfizer brand product hasn’t been launched for commercial reasons. So market analysis is just as important for both original and generic products. Too much self-confidence and the lack of reliable market analysis may lead to investment failure.

But as a Latin quote says “Ignorantia legis non excusa” which means “ignorance of the law excuses not”. In this case we shall change the word “law” to “market” and that also will be the truth.

Why pharmaceutical companies fail and why should they decide to spend money on analysis?

According to Sun et al., the main reasons why 90% of drug development failed were:

- the lack of clinical efficacy,

- unmanageable toxicity,

- poor drug-like properties,

- lack of demand and poor strategic planning.

Later, during a product launch, more than half of drug failures are attributed to:

- limited market access (e.g. high patient cost-sharing, lack of coverage),

- inadequate understanding of market and customer needs (e.g. difficulty with convincing customers to the new therapy)

- and poor product differentiation.

But these are the results of poor project management, during whole commercialization process. The solution shall be having a critical approach, strong and well developed teamwork driving into the optimal market entry strategy based on the commercialization roadmap developed by an experienced market analyst. The last one requires the possession of experts of holistic approach to the project. Such an expert should demonstrate the broad knowledge in distinct fields, strong analytical skills to prepare appropriate research and a sharp mind to come with strategic conclusions. However, it can be difficult especially for small companies which do not need to employ such experts for full-time job, don’t have experience in abroad markets and have to pay a lot of money only for plain data. Therefore, market analysis services are often outsourced which gives companies the freedom of action without the necessity of engagement of all resources.

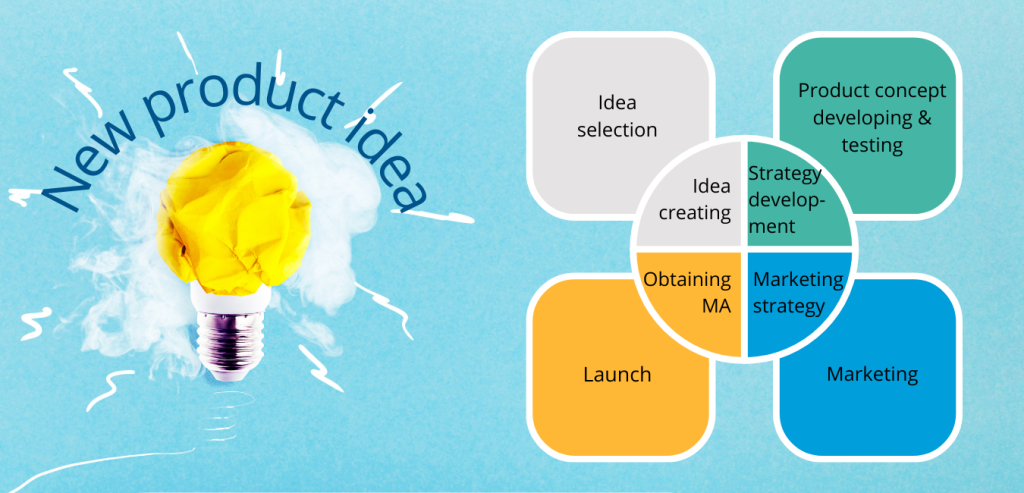

New project

After considering implementation of the new product there are a few highlights to pay attention to:

- Idea creating – this process requires a creative and open-minded team, which can use one of the technics like: brainstorming, mind mapping etc.

- Idea selection – in this step it is worth having in the team experienced peers, who have made the selection of previous ideas according to their newest knowledge. It is possible to assess the idea with a SWOT analysis which requires an exact product description, timeframe, budget and resources.

- Strategic development – commercialized product besides profits should carry additional value as clients’ satisfaction or improving knowledge of the team or company. Achieving this goals is possible with the assessment of the commercial potential of an innovation or technology.

- Product concept developing and testing – during this step, the company collects more detailed data about customer needs. The most popular method is via surveys. Within this step the market analysis is prepared.

- Marketing strategy – according to previous market analysis the marketing strategy is created, it takes into account product characteristics, launch method and product life cycle in the market. Basically, it consists of 3 parts: (I) definition of the target market, (II) pricing and reimbursement approach (important for price and availability for patients), (III) sales forecasts.

- Obtaining Product Marketing Authorization (MA) – a pharmaceutical product to be included in the company’s commercial portfolio can be obtained in two ways – by self-development of a new product and obtaining marketing authorization for it or by purchasing a license (i.e. for product distribution) from another entity (e.g. Marketing Authorization Holder, MAH).

- Launch – it is important for launch to occur at the right time so that the patient finds the product in the pharmacy exactly at the moment when there is a market need for it.

- Marketing -All of the actions that are undertaken to maintain a “star” or “cash cow” status of the product, starting from constant market monitoring and appropriate reactions to changes, thru post-authorization procedures to allowed advertisement and campaigns.

Market analysis

As previously mentioned there are many steps to drive medicinal product into the market with market analysis as one of the most important. The key activities performed within this step involve: scientific and specific literature review, data collecting, data analysis and reporting.

Qualitative and quantitative research and analysis of the commercial potential of the product allow to answer questions important for assessing the profitability of the product to be entered into the market and from the point of view of its further marketing:

- product evaluation – products advantages, currently available options, existing competitors, timing, shelf-life and stability in different climate markets,

- market characteristics – market size, drivers and barriers, market dynamics, opportunities, restrains, forecasting, assessment of the sale and distribution channels (worth checking a risk of parallel import appearance),

- regulatory scope – regulatory affairs analysis for the key markets, legislative changes that may affect market access (e.g. indication might have an influence on the reimbursement application or obtaining an OTC status)

- likely demand for the product – numbers of incidents, epidemiology and therapy necessity,

- existing competitors – global market share analysis, purchasing decisions – product preference, consumer buying pattern, current therapies and their success; competitive charts, comparative analysis – major players, major company profiles (overall, products and services, SWOT analysis, recent development projects, strategies, finances),

- market access and pricing matters – reimbursement process (and different types of reimbursement e.g. national, regional or local; for Rx medicinal products, conditional for Rx medicinal products or conditional reimbursement for OTC products) and product market entry policy, price-changer drivers, product price expectations, payers, market condition.

The above mentioned conditions should be taken into consideration in order to correctly predict the possible market share and estimate the price that shall work optimally for an analyzed product. Although some of these points may be slightly different depending on whether it is an innovative or generic/biosimilar product. Nevertheless, the main assumptions don’t change.

Market analysis constitutes an inherent element during the R&D process of the medicinal product. Proper evaluation, carried out at the right moment not only prevents losing a fortune, but also contributes to the company development. It should also be borne in mind that market analysis is not just about determining the market size, but it is also necessary to assess brand specificity, therapeutic appropriateness in the market, which will allow understanding the needs of doctors and patients.

Bibliography:

- https://www.fiercepharma.com/special-report/10-top-drug-launch-disasters

- https://www.fiercepharma.com/marketing/sanofi-agrees-to-pay-2-4m-to-zaltrap-sales-reps-fight-over-discounted-commissions

- Sun D, Gao W, Hu H, Zhou S. Why 90% of clinical drug development fails and how to improve it? Acta Pharm Sin B. 2022 Jul;12(7):3049-3062.

- Pojda, M. Etapy projektu wdrażania nowego produktu w branży farmaceutycznej. Journal of Modern Management Process 2018, 3 (nr 2 Podejścia do zarządzania we współczesnych organizacjach), 35–46.

- Becker, M. C., & Lillemark, M. (2006). Marketing/R&D integration in the pharmaceutical industry. Research Policy, 35(1), 105-120.

- https://www2.deloitte.com/xe/en/insights/industry/life-sciences/pharmaceutical-market-access.html

- https://www.ema.europa.eu/en/documents/withdrawal-letter/withdrawal-letter-pemetrexed-ditromethamine-hospira_en.pdf

- https://www.ema.europa.eu/en/documents/public-statement/public-statement-pemetrexed-pfizer-cessation-validity-marketing-authorisation-european-union_en.pdf